Dubai's Land Crunch Is Now the Story (Not Demand)

2025 just printed a record year - the next bottleneck is buildable land, not buyers.

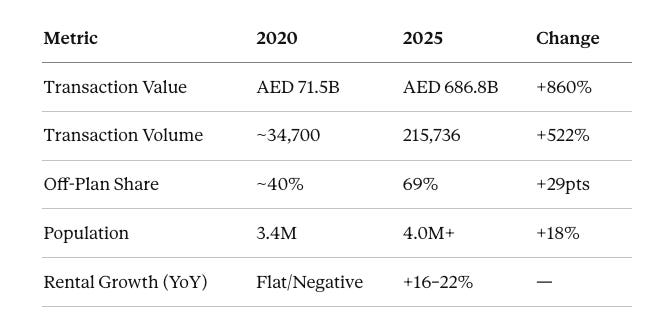

Dubai’s real estate market just closed its strongest year ever. AED 686.8 billion across 215,736 transactions - up 31% and 19% respectively from 2024. The headlines tell a story of insatiable demand. They’re missing the bigger shift.

The constraint in Dubai real estate is no longer whether buyers show up. It’s whether there’s anything left to sell them.

Plot prices surged 17.7% year-over-year in October 2025, nearly triple the appreciation rate of apartments. Villa transactions climbed 23.9%. Waterfront assets appreciated 140% over five years. Meanwhile, apartment delivery fell to just 62% of forecast, and master developers are maintaining disciplined phasing rather than releasing land opportunistically.

This isn’t a demand story anymore. It’s a supply story. And the smart money is repositioning accordingly.

The analysis in this piece draws on DLD transaction data, developer brochures, and market comparables sourced through Buildable, the AI-powered research platform I'm built for Dubai real estate professionals.

If you’re a Dubai real estate professional or team, book a demo here, or start a 7 day trial here.

Today’s Brief:

What “buildable land” actually means in Dubai - and why it’s structurally constrained

The 2021 flip: how Dubai went from demand-constrained to supply-constrained

Where the bottlenecks are tightest: villas, waterfront, and infrastructure-linked corridors

What master developers are actually doing with their land banks

The investment implications for the next 5 years

What “Buildable Land” Actually Means

The phrase “Dubai has plenty of desert” is the most common misconception in Gulf real estate. Buildable land in Dubai is constrained by five interconnected dimensions that most outsiders don’t understand.

Zoning and FAR limits are hard ceilings.

Dubai’s land is classified into primary zones - residential, commercial, mixed-use, industrial - each with strict Floor Area Ratio limits. Residential zones typically permit FAR of 1.5–3.5; commercial zones 3.75–4.0. This means a 10,000 sqft plot can yield only 25,000–35,000 sqft of buildable area. No variance, no exceptions. Road width also matters: properties on roads wider than 60 feet can access 60% additional FAR by paying 28% of the property’s guidance value as a fee. Without strategic road frontage or municipal variance, a plot’s development potential is locked from day one.Freehold restrictions create artificial scarcity.

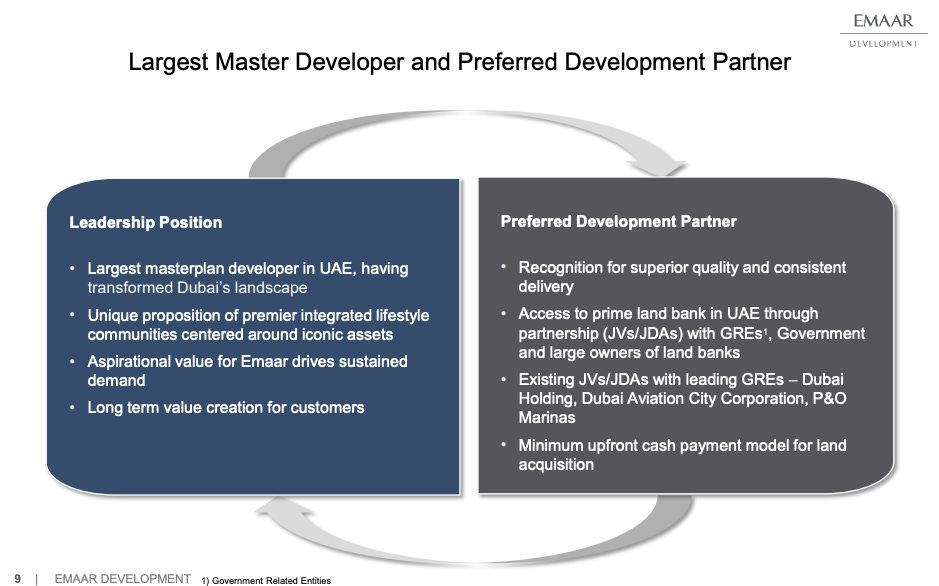

Only ~40 designated freehold zones in Dubai allow foreign ownership in perpetuity. Most land outside these zones is leasehold, up to 99 years. Foreign investors - who drive roughly 50% of Dubai’s investment value - can only acquire land in geographically limited, often already-developed areas. The January 2025 announcement to convert 457 plots in Sheikh Zayed Road and Al Jaddaf to freehold eligibility was a deliberate policy move signalling government recognition of land scarcity in prime central zones.Master developers control the supply valve.

Approximately 80 - 90% of large buildable plots (>5,000 sqft) in emerging zones are controlled by master developers - Emaar, Nakheel, Damac, Azizi, Sobha. These developers maintain disciplined land release schedules tied to infrastructure phasing, not market demand. Emaar’s land bank strategy, for example, involves minimal upfront land acquisition, preferring JV/JDA structures with government entities and holding long-term plots. The Oasis alone is 81 million sqft, phased 2027–2030.Infrastructure readiness is a gating factor.

A plot is buildable only if utilities (water, power, sewage), transport connectivity, and municipal services are in place or committed. The Dubai 2040 master plan concentrates urban development into five urban centers; plots outside these corridors face higher infrastructure costs and regulatory uncertainty. This concentrates land value into infrastructure-linked corridors - Metro Blue Line, Etihad Rail, Al Maktoum Airport - making greenfield plots in emerging areas less attractive unless tied to major transport projects.Natural geography and policy reserves constrain the rest.

Dubai 2040 dedicates 60% of the emirate’s land to nature reserves, rural areas, and green corridors. Only ~40% is allocated for urban, industrial, and commercial development - roughly 1.7 billion sqft total. Waterfront land is especially constrained: Nakheel’s Palm Jebel Ali (13.4 sqkm) will add 100+ km of coastline, but is phased through 2040. No major new waterfront supply enters the market until 2027+, crystallising waterfront villa premiums for the next 3–5 years.

The 2021 Flip: From Demand-Constrained to Supply-Constrained

To understand where we are, you need to understand where we were (great life-hack!).

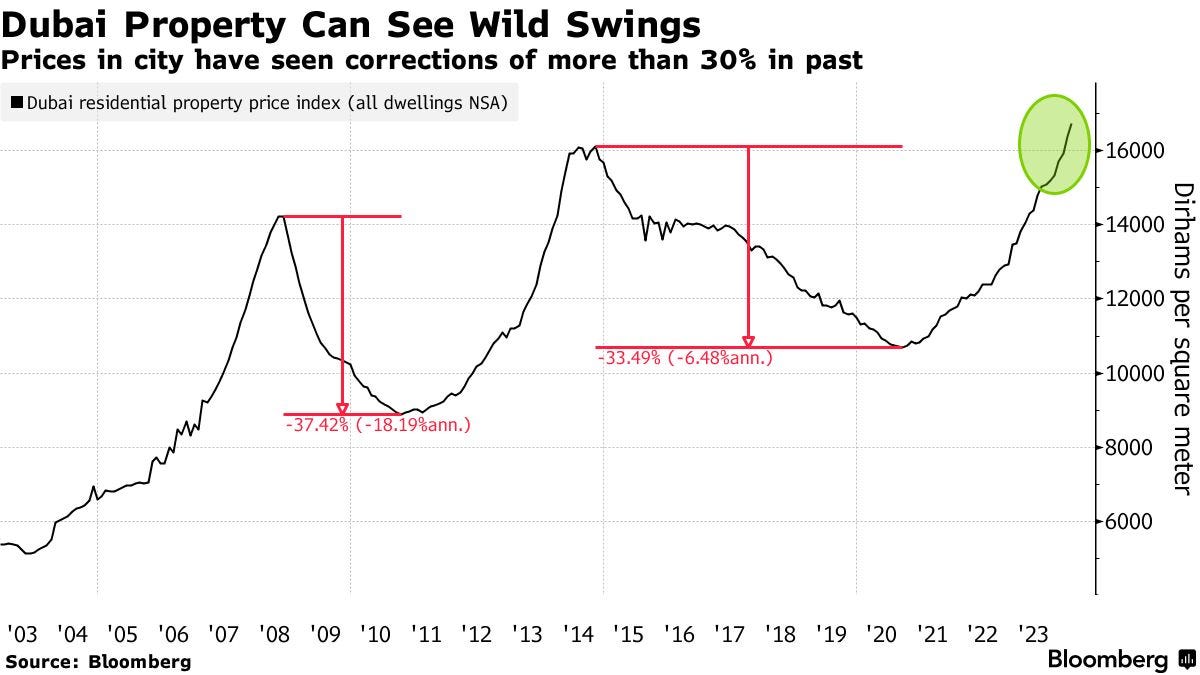

2014–2020 was a demand problem

Post-2009 financial crisis recovery meant weak buyer appetite. From 2016 to 2019, property prices declined year after year—prices fell 4.05% in 2019, following declines of 8.22% in 2018, 5.23% in 2017, 2.86% in 2016, and 14.1% in 2015. In 2020, total transaction value was just AED 71.5 billion across ~35,000 deals. Developers struggled with off-take. The bottleneck was demand, not supply.

The inversion occurred in 2021

Sheikh Mohammed bin Rashid announced Dubai Real Estate Strategy 2033, expanded freehold eligibility, introduced Golden Visa (long-term residency for investors, retirees, remote workers), and relaxed family sponsorship rules. Simultaneously, pandemic-era remote work accelerated inbound migration. By 2023, the population acceleration became undeniable: +4.47% year-over-year as of 2025, requiring roughly 150 new homes daily.

The numbers tell the story of the flip:

Supply hasn’t kept pace. 2025 actual deliveries came in at approximately 42,000–44,000 units—just 62% of forecasted completions, with under-delivery driven by project sequencing and infrastructure timelines. Villa supply remains severely constrained: only 15,284 villas are scheduled for 2026, falling to just 5,631 for 2027. Established communities like JVC and Business Bay maintain 90%+ occupancy rates year-round, with JVC specifically holding a 94% occupancy rate as of September 2025 despite significant new supply entering the market.

The pivot is stark. In 2020, developers worried about absorption. In 2025, buyers compete for limited ready inventory, and developers prioritise off-plan pre-sales to lock in demand before handover risk. Absorption rates now exceed delivery rates - a structural inversion that won’t reverse quickly.

Where the Bottlenecks Are Tightest

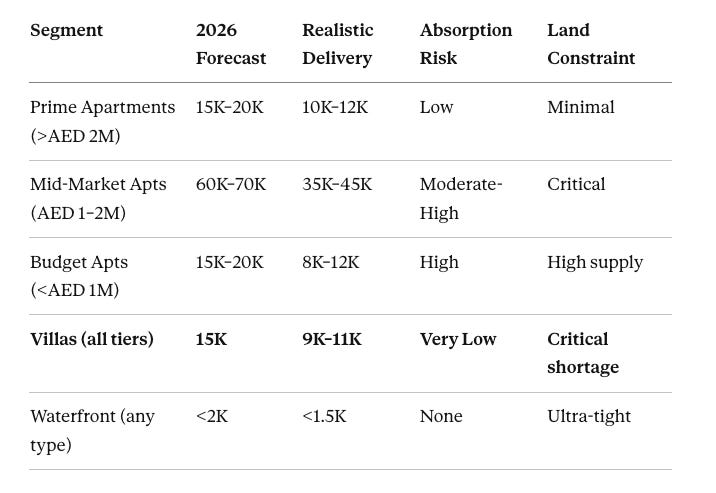

Not all segments are equally constrained. The market is bifurcating into two tiers: genuine scarcity assets, and high-supply compression zones.

Villas: The Acute Shortage

Villas represent only 15,284 of the 99,686 forecasted 2026 units - roughly 15% of pipeline. Demand is unlimited at current prices. Time-to-sell is holding steady at 30–45 days; long queues persist for ready villas. End-users - not investors - now dominate; long holding periods reduce resale turnover; synthetic scarcity is emerging via behavioural lock-in.

The Springfield Properties villa analysis captures this dynamic: villa markets face persistent supply-demand imbalance with investment pressures intensifying, not easing.

Waterfront: Engineered Scarcity

Waterfront premium now runs 30–60% above non-waterfront comparables. Palm Jumeirah waterfront villas appreciated 140% in five years. Villas represent 33% of rental transactions but 58% of rental value.

With 60% of Dubai’s land reserved for nature/rural use, and Palm Jebel Ali not delivering meaningful supply until 2027+, waterfront scarcity is engineered by policy, not market forces. This isn’t cyclical. It’s structural.

Infrastructure-Linked Corridors: Premium by Design

The Metro Blue Line (30 km, station installations underway) is expected to drive +18–24% property value growth in Dubai Creek Harbour, International City, and new urban centers. Transit-oriented land commands premiums; underserved areas (Dubai South, Al Ghadeer) are seeing speculative interest ahead of station completion.

Etihad Rail freight loop connection to Jebel Ali Port is expected to drive +38% industrial land growth in Dubai Industrial City.

Infrastructure concentration equals geographic land scarcity. Only plots near major transport nodes appreciate meaningfully. Plot inventory outside corridors remains subdued. Scarcity is being engineered through infrastructure centralisation, not market forces alone.

Mid-Market Apartments: The Compression Zone

The warning signs are selective, not systemic. High-supply sub-segments - studios and 1-beds in JVC, Business Bay, Arjan - may see 5–10% softening. But family apartments and villas remain tight.

Fitch has warned of 15% correction risk if the full pipeline delivers on schedule. But Fitch caveated: “if delivered on schedule.” Base case is 5–8% normalisation, not crash. Historical non-delivery runs 30–40%. The two-tier market is the story, not a uniform correction.

What Master Developers Are Actually Doing

The clearest signal that land is the constraint comes from developer behaviour. If demand were the bottleneck, developers would release land faster to capture it. They’re not.

Emaar’s land bank strategy is instructive. 316.3 million sqft remaining land bank as of H1 2025. Phased delivery through 2030. The Oasis alone (81 million sqft) is phased 2027–2030 despite immediate demand. Minimum upfront cash payment model. JV/JDA structures preserve land for long-term value capture.

Nakheel is waterfront-focused with multi-decade timelines. Palm Jebel Ali (13.4 sqkm) phased through 2040. Dubai Islands ongoing. No aggressive land release.

Damac maintains brand discipline over volume. Premium/branded focus constrains land bank positioning.

Azizi is the volume player. Higher-density focus maximises land efficiency but doesn’t solve the villa/waterfront constraint.

Conclusion: Master developers are extracting scarcity premium, not racing to deliver. Disciplined phasing is industry standard. This is rational land-owner behaviour, not market failure. They learned from 2008–2014. They won’t repeat it.

Plot Prices Tell the Truth

When capital repositions, it tells you where the smart money sees value. The plot market in 2025 is telling a clear story.

399 land transactions in October 2025 worth AED 11 billion. Average plot price AED 7 million (+17.7% YoY). Plot transaction volume +23.9% YoY.

Compare that to apartments: +0.5–7% YoY in established areas. The spread is stark.

Plot Price Benchmarks by Segment:

Capital is fleeing apartment-heavy areas and repositioning into land plots. That’s a vote of confidence in land scarcity.

The Commercial Parallel

While residential land drives headlines, commercial land scarcity is equally acute and strategically underreported.

Office market indicators:

Occupancy: 92% citywide; 95% Grade A in DIFC, Sheikh Zayed Road, One Central

Rent growth: AED 190/sqft average (+22% YoY); DIFC >AED 400/sqft fitted

Supply 2025: Only 215,000 sqm entering market; most pre-committed

2026–27 Pipeline: 6.4 million sqft, but concentrated in prime zones

Industrial and logistics are outperforming all segments:

Institutional investors attracted by long lease terms, strong occupier demand, higher yields than office/hospitality

Infrastructure: Etihad Rail Freight Loop + Jebel Ali Port expansion driving logistics land premium

The broader point: Dubai’s infrastructure is overloaded relative to buildable capacity across all property types. The land crunch isn’t just residential - it’s systemic.

The 2026 Reality Check

The pipeline numbers get thrown around carelessly. Let’s be precise.

Forecasted: 99,686 apartments + 15,284 villas = ~115,000 units for 2026.

Historically realistic (accounting for 30% delays): 60,000–70,000 units.

Daily requirement (population +4.47% YoY): ~150 homes/day = ~55,000 annually.

Net gap if realistic 60K delivered: +5,000 units (tight but workable).

Risk if only 50K delivered (40% delay rate): –5,000 units (undersupply persists).

The math suggests 2026 will be tight but manageable in aggregate. But aggregate masks the bifurcation:

The market is NOT uniformly over-supplied. Two-speed correction likely: mid-market apartments may see 5–10% softening in high-supply pockets; villas, waterfront, and plot-based development remain supply-constrained with upside appreciation risk.

What Would Break This Thesis

Any honest analysis requires stating what would prove it wrong.

Signal 1: Rental yield compression below 5% (apartments). Currently 6–8% gross in established communities; 5.5–6.5% net. If this falls to <5% net, oversupply is real.

Signal 2: Apartment price decline >10% QoQ in high-supply zones. October 2025 average was AED 1,692/sqft. Falls to <AED 1,520/sqft within 6 months would signal demand cliff.

Signal 3: Villa ready inventory spike to >20% of standing stock. Currently <10% available for resale. If inventory duration rises from 30–45 days to 90+ days, scarcity thesis collapses.

Signal 4: Master developer acceleration (unscheduled plot release). If major developers start releasing new plots ahead of schedule or outside JV/JDA structures, developer capital pressure is forcing supply - scarcity premium breaking down.

Signal 5: Interest rate shock + affordability crisis (mortgage demand collapse). 4.49 - 4.99% fixed rates available; delinquency <1%. If mortgage delinquency hits >3%, rejection rates >20%, or application volumes drop >30%, financing stress is real.

Current status on all five signals: Green. None are flashing.

The Investment Implications

For the next five years, the land-crunch thesis suggests several positioning strategies:

For developers: Pivot from pure pre-sales models toward land accumulation and rental-hold strategies. The operators who control land control returns. Disciplined phasing will beat volume plays. Villa and waterfront-focused portfolios will outperform apartment-heavy portfolios.

For investors: Plot acquisition in infrastructure-linked corridors offers the clearest asymmetric upside. Villa plots in emerging prime zones (Dubai Hills periphery, Tilal Al Ghaf expansion areas) command premiums for a reason. Apartment exposure should be selective - avoid high-supply mid-market pockets; favour family-sized units in established communities.

For family offices: This is the moment to acquire land at scale. The January 2025 freehold conversion signalled government willingness to monetise land scarcity. More conversions likely follow. First-mover advantage in newly-eligible freehold zones will be significant.

For operators: Build-to-rent and coliving models I’ve written about previously become more compelling as rental pressure intensifies. With rents up 16–22% YoY, the case for institutional rental portfolios strengthens. The land crunch makes development more expensive - but it also makes holding and operating rental assets more valuable. The real problem is construction finance for income-producing schemes, but once that changes, this all changes.

The View from 2030

By 2030, I expect the Dubai market to look structurally different:

Land ownership will be more concentrated. Master developers with disciplined land banks will control an even larger share of buildable capacity. The secondary market for plots will thin further as institutional capital consolidates positions.

The villa premium will persist or widen. Unless developers dramatically accelerate villa delivery (unlikely given land economics and margin preferences), villa scarcity will become self-reinforcing. End-users buying and holding reduces turnover, tightening supply further.

Infrastructure will determine geography more completely. Metro Blue Line completion, Etihad Rail full operation, and Al Maktoum Airport relocation will concentrate development even more tightly along transport corridors. Out-of-corridor land will trade at meaningful discounts.

Tokenisation may democratise access without solving scarcity. The DLD’s Prypco Mint pilot - fractional ownership from AED 2,000, 149 investors acquiring shares in a tokenized villa in under 2 minutes - signals a liquidity response to scarcity. If land were abundant, no need to fractionate. Tokenisation is capital democratisation responding to asset scarcity.

Commercial land scarcity will drive the next wave of innovation. With office occupancy at 95% Grade A and industrial at 97%, commercial development faces even tighter constraints than residential. Expect vertical integration, mixed-use intensification, and premium pricing to accelerate.

The Bottom Line

Dubai’s 2025 record year masks a profound structural shift. Demand remains robust, but buildable land - the fundamental constraint - is now the binding factor, not buyer appetite.

The evidence is specific and measurable.

The 2021 inversion from demand-constrained to supply-constrained won’t reverse quickly. Master developers learned from 2008–2014. They’re extracting scarcity premium, not racing to deliver.

For investors, developers, and operators, the implication is clear: the constraint has shifted. Understanding that shift - and positioning accordingly - will separate the winners from those still playing the 2020 playbook.

The land is finite. The demand isn’t going anywhere. The question is who recognised the flip early enough to act on it.

If you're a broker, developer, or investor who spends hours pulling DLD comps and building market reports, valuations, broker reports, or feasibility studies manually, Buildable does it in minutes. Start a 7-day free trial or book a demo to see it in action.

Until next time,

Zakee