The Emaar Model

Lessons from Dubai's $35 Billion Developer

With an AED 146.3 billion revenue backlog, a net margin of 53%, and stock price up 86% in 18 months, Emaar have built something that transcends traditional real estate economics. Although I couldn’t find up-to date figures, stats from 2019 show that Emaar owned a 36% market share in off-plan sales in Dubai’s property market.

The question is: how does a regional player generate tech-like returns from concrete and steel?

Today’s Brief:

How Emaar Started

How the Business Works

What Makes It Work

Where the Model Struggles

The Next Decade: What Emaar Tells Us About Real Estate's Future

How Emaar Started

The Government Mandate (1997-2002)

Emaar's story begins in 1997 in a government office. Founded as a public joint-stock company during Dubai's transformation push, Emaar was conceived as an instrument of state-building – tasked with creating world-class communities that would put Dubai on the global map.

The early backing from Dubai's government and ruling family was strategic. While other developers fought for permits, Emaar had a mandate. Their first major project was in 1999, Emirates Living, the first major freehold integrated lifestyle masterplan community in Dubai. By 2000, Emaar launched Dubai Marina and went public in one of Dubai's first major IPOs, signalling that this government-backed entity would operate with public market discipline.

Building the Foundation (2002-2008)

The mid-2000s saw Emaar make its biggest bets. Downtown Dubai was an attempt to create a new city centre from scratch. The Burj Khalifa project was ambition made concrete. Dubai Mall was conceived not as a shopping centerebut as community infrastructure.

International expansion began in Egypt, Saudi Arabia, Turkey, and India.

Surviving the Crisis (2008-2014)

Then came 2008. Dubai property prices crashed more than 50%. Developers went bankrupt. Projects stalled. Emaar kept building.

Instead of launching new projects to maintain cash flow, they focused on completing existing ones. Delivering Burj Khalifa in 2010, in the depths of the crisis, sent a signal to the market. Dubai Mall opened to 54 million visitors in its first year.

Building the Modern Business (2014-Present)

The announcement of Dubai Expo 2020 catalysed a new development cycle. The master community strategy – Dubai Hills, Creek Harbour, Emaar South – wasn't about individual projects anymore but creating entire ecosystems.

Technology adoption accelerated, with digital sales platforms becoming standard. The result: AED 70 (US 19) billion in property sales in 2024, up 72% year-over-year.

How the Business Works

Property Development: The Core Engine

UAE Property development drives 66% of Emaar's revenue. Property sales hit AED 70 billion in 2024, growing 72% year-over-year.

Emaar’s dominance comes from their master community strategy. Downtown Dubai, Dubai Hills Estate, Dubai Creek Harbour – these are cities within cities, each with its own identity and infrastructure.

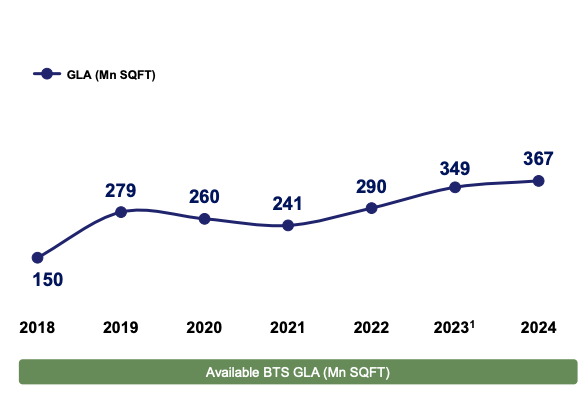

The land bank tells the future story: 367 million square feet in the UAE alone. That's enough land for a decade of development at current rates. In 2024, they acquired 141 million square feet for AED 96 billion – prime Dubai land that immediately enters the development pipeline.

Recurring Revenue: The Stable Foundation

34% of Emaar's revenue comes from recurring sources (e.g. malls, hospitality, leisure, entertainment, and commercial leasing).

Dubai Mall generates AED 14.8 million daily. With 105 million visitors in 2023, it's the world's most-visited mall. The retail portfolio maintains 97% occupancy.

The hospitality portfolio – 38 hotels with 9,200 keys – operates at 50% EBITDA margins. For context, Marriott runs at <20% EBITDA margins. The difference: Emaar owns the real estate and the operations.

Commercial leasing adds another layer with 1.4 million square meters of leasable space. Recurring revenue grew 26% in 2023, faster than the overall business.

Government Partnerships: The Strategic Advantage

Emaar's government partnerships go beyond land deals. They're about aligned incentives at the highest level.

The Dubai Creek Harbour joint venture with Dubai Holding is a new city for 200,000 residents. The Emaar South partnership with Dubai Aviation City Corporation is housing for the aerospace industry ecosystem. These aren't deals Emaar negotiated – they're mandates Emaar executes.

Investment Corporation of Dubai as a major shareholder and backing from Mohammed bin Rashid Al Maktoum means Emaar operates with commercial discipline and strategic patience. When they acquired 141 million square feet for AED 96 billion in 2024, it was a strategic allocation of resources with government alignment.

What Makes It Work

Vertical Integration That Actually Matters

Most developers coordinate rather than create – they hire architects, contractors, brokers, and management companies. Each handoff adds cost and delays. Emaar brought everything in-house, capturing higher operating margins than fragmented competitors.

The real advantage is speed and information flow. When design, construction, sales, and management teams work together, problems get solved quickly. Property management data feeds directly back to development. Managing 108,000+ delivered units creates a feedback loop competitors can't match.

Small efficiencies compound: proprietary furniture specs mean bulk purchasing power, standard designs mean faster approvals, in-house construction eliminates contractor markups. Multiply these across thousands of units and you get structural advantages.

What to learn: Start with one function that's hurting margins or causing delays. Perfect it in-house, then expand. Emaar built these capabilities over decades, not overnight.

Building Ecosystems, Not Projects

Emaar commands premiums over market averages because they don't sell apartments – they sell addresses.

Downtown Dubai works because it's complete: Dubai Mall, Burj Khalifa, fountains, restaurants, offices. Everything reinforces everything else. The mall drives residential demand, residents support retail, hotels bring buyers. Downtown maintains 87% occupancy at AED 2,600 per square foot because the ecosystem is irreplaceable.

Emaar owns all of it. The mall that makes apartments valuable, the hotel where buyers stay, often the office where residents work. They capture not just development profits but the economic value their developments create.

What to learn: Think ecosystems, not projects. Every amenity you own rather than outsource is both a profit centre and value driver for core development.

Where the Model Struggles

The Replication Problem

Emaar's international operations reveal a fundamental limitation: the model doesn't export well. Despite the same brand and expertise, international operations generate just 8% of total revenue while consuming disproportionate management attention and capital.

The India operations illustrate this starkly – AED 2.4 billion in losses in 2023-24, double the previous year. Why? The ecosystem model requires market density that's hard to achieve as a foreign entrant. You can't build Dubai Mall in Mumbai when you don't control the surrounding infrastructure, regulatory framework, or have the patient capital that government partnerships provide.

Egypt performs better with profits doubling to EGP 15 billion, but only because Emaar secured similar government alignment there. The lesson: Emaar's competitive advantages are geography-specific, not company-specific. They're a function of market position and relationships that took decades to build.

The Complexity Ceiling

Managing 42,000 units under construction while maintaining 50%+ margins requires exceptional coordination. But there's a natural ceiling to this complexity. Each additional project adds non-linear coordination costs. Each new business line multiplies interdependencies.

The vertical integration that drives margins also creates rigidity. When you own everything, you must manage everything. A specialised developer can switch contractors if one underperforms. Emaar must fix internal problems internally. This works at current scale, but where's the breaking point?

The Cycle They Haven't Faced

Emaar survived 2008, but that crisis hit when they were smaller, simpler, and had less fixed overhead. Today's Emaar – with 38 hotels, massive retail operations, and thousands of employees – hasn't faced a serious downturn.

92% revenue concentration in the UAE means Emaar is essentially a leveraged bet on one economy. The recurring revenue streams provide some cushion, but retail and hospitality are cyclical too. When Dubai catches a cold, Emaar gets pneumonia. The difference now is they're too big to pivot quickly.

The pre-sales model that provides capital efficiency also creates delivery obligations. In a downturn, you still must build what you've sold, even if construction costs spike or buyers struggle with payments. The AED 146.3 billion backlog is both an asset and an obligation.

The Next Decade: What Emaar Tells Us About Real Estate's Future

The REIT Revolution That Isn't Coming (Yet)

Emaar's 100% dividend payout already gives shareholders REIT-like distributions without the constraints. REIT structures would limit their development flexibility and require separating their integrated model. Why would they constrain themselves when they already have access to capital at favourable terms?