Dubai Real Estate for $136? Yes, Really.

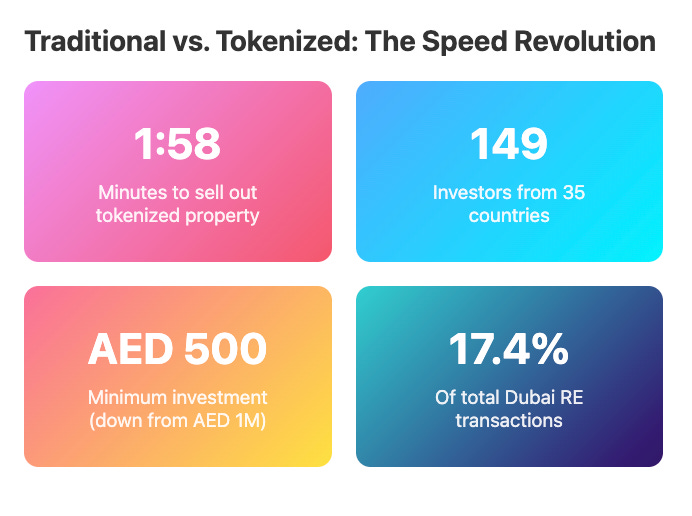

Forget crypto - Dubai just tokenised a villa and it sold out in 1 minute 58 seconds to 149 investors from 35 countries.

That's not a typo. We're talking about actual Dubai property ownership, not some sketchy JPEG. The AED 1 million minimum that kept regular investors out? Dead. The old boys' club of real estate? Disrupted faster than taxis watching Uber eat their lunch.

The Macro Picture Nobody Saw Coming

Dubai's real estate market just made property ownership as easy as …