7 Saudi Real Estate Opportunities Before Vision 2030

+ how to reach family offices/investors in Saudi

A Saudi family office just deployed $135 million into a digital real estate fund in 5 months. Meanwhile, Western developers are still pitching luxury villas to a market that's fundamentally transformed. The $72 billion Saudi real estate market is experiencing its iPhone moment - and most operators are still selling Blackberries.

Today’s Newsletter:

The $132 Billion Transformation - Why Saudi's real estate market is fundamentally reinventing itself, not just growing

7 Opportunities Before Vision 2030 - From foreign ownership arbitrage to mega-project workforce housing

The Execution Playbook - How to find partners, structure deals, and navigate Saudi's unique market dynamics

Who's Already Winning - ROSHN, Qiddiya, and the smart money moves happening now

My 2-Year Forecast - Specific predictions for 2025-2027 based on 50+ family office conversations

Your 90-Day Action Plan - Tactical blueprint to go from zero to first deal

Premium Resources - My GCC investor database + the cold outreach sequences that got me into tier-1 boardrooms

The $132 Billion Transformation Nobody's Talking About

Last month, I was on a Teams call with a Saudi family office principal. "Western developers keep showing us the same luxury projects," he said, scrolling through his phone. "But look at this." He showed me ROSHN's app - 50% of their home sales now happen entirely online. No site visits. No lengthy negotiations. Just click, buy, done.

This conversation crystallised something I've been tracking for 18 months: Saudi Arabia's real estate market isn't just growing - it's fundamentally reinventing itself.

The Numbers That Matter

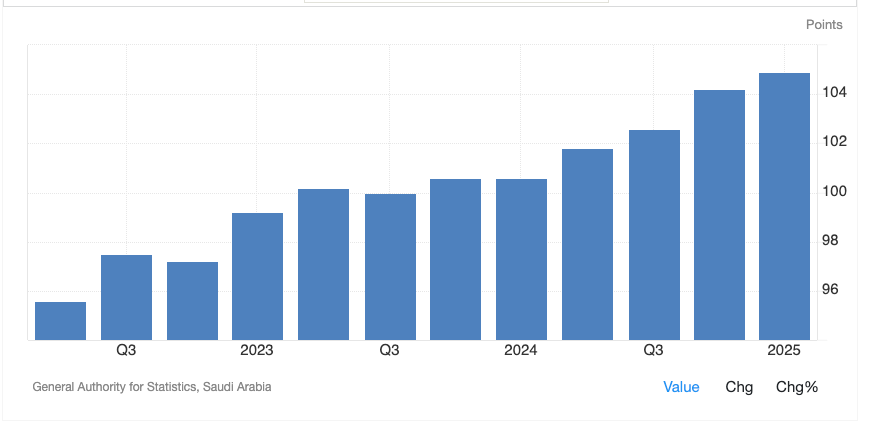

The raw data tells only part of the story. Yes, the market is exploding from $72.11 billion in 2024 to a projected $132.65 billion by 2033 - a 7% CAGR that would make any investor salivate. But dig deeper and the transformation becomes clear:

Real estate transactions surged 47% year-on-year to $75.7 billion in 2024

Residential transactions alone hit SAR 118 billion ($32 billion)

Commercial real estate prices jumped 11.7% annually

Grade A office rents in Riyadh reached SAR 2,700 ($720) per square meter

But here's what the headlines miss: this isn't cyclical growth. It's structural transformation.

The Three Catalysts Creating This Gold Rush

1. Demographics

Saudi Arabia has a secret weapon: 70% of its population is under 35. Unlike their parents, this generation doesn't rush to buy homes. They rent. They move. They demand flexibility. And they're comfortable transacting entirely online.

This isn't speculation - it's already happening. When ROSHN reports that half their sales occur digitally, they're not talking about virtual tours. They're talking about complete end-to-end digital transactions for properties worth hundreds of thousands of dollars.

2. The Regulatory Revolution

January 2026 will mark a watershed moment: foreigners can own property in Saudi Arabia. Not through complex structures. Not through local partners. Direct ownership in designated zones including Riyadh and Jeddah.

But the government isn't stopping there. The White Land Tax just jumped from 2.5% to 10% annually on undeveloped land, plus a new 5% tax on vacant buildings. This isn't just policy - it's forced velocity. Landowners sitting on empty plots suddenly face crushing carrying costs.

3. The Digital Leapfrog

Here's what Western operators consistently miss: Saudi Arabia never built legacy real estate infrastructure. No ancient MLS systems. No paper-based processes defended by guilds of intermediaries. They're building digital-first from day one.

"The Gulf has the advantage of learning from Western mistakes without having to live through them. Saudi's digital infrastructure is being built for 2030, not patched together from 1990."

Why Western Operators Keep Missing It

I've watched dozens of Western real estate companies enter Saudi with the "Dubai template" - luxury towers, Western amenities, English-only marketing. They almost universally fail.

Here's why:

They're still pitching luxury when the market desperately needs affordable quality

They ignore the 400,000-unit pipeline from ROSHN alone

They miss that REITs already manage SAR 30 billion in assets

They don't understand that Saudi families want 4-bedroom units, not studios

My Secret Weapon

Over the last 18 months, I've built something invaluable: direct relationships with Saudi's tier-1 developers and family offices. My GCC Real Estate Investor Database now includes 700+ active investors.

AND, I'm sharing the exact cold outreach sequence that got me meetings with decision-makers at ROSHN, major Saudi family offices, and government-backed funds (check the end of this post).

This isn't theoretical. I went from zero connections to sitting in boardrooms with billion-dollar developers in 90 days. No wasta required - just the right approach.

The 7 Opportunities That Will Mint Millionaires

After analysing hundreds of data points and dozens of conversations with Saudi investors, seven opportunities stand out as generational wealth-creation moments.

1. The Foreign Ownership Arbitrage Play

Come January 2026, the gates open. Foreign buyers can purchase property in designated zones across Saudi Arabia. But here's the arbitrage: prices haven't yet baked in this demand surge.

Smart money is moving now, partnering with local developers to secure inventory before the law takes effect. The Riyadh-Jeddah corridor particularly offers compelling opportunities - urbanisation is driving massive population flows between these mega-cities.

The play: Partner now, develop or secure inventory, sell to international buyers post-2026 at 30-40% premiums.

2. The White Land Tax Flip

The 10% annual tax on undeveloped land is Saudi's nuclear option against speculation. Add the new 5% tax on vacant buildings, and you have a perfect storm of motivated sellers.

I'm already seeing early signs: family offices quietly shopping distressed land portfolios. Owners who bought land as a store of value now face $10 million annual tax bills on $100 million parcels. They need to develop or sell. Fast.

The play: Create development joint ventures with distressed landowners. They bring land, you bring development expertise and capital. Split the profits from rapid development.

3. The RHQ Corporate Housing Gold Mine

The Regional Headquarters Program isn't optional - international companies must establish Saudi HQs by 2024 or lose government contracts. The incentive? 30-year tax exemption at 0% corporate tax rate.

This creates unprecedented demand for corporate housing in specific zones. Not luxury - functional, Western-standard housing for thousands of relocating executives.

The play: Master lease agreements with corporate tenants offer 3-5 year guaranteed income at premium rates.

4. The NEOM Adjacent Play

Everyone knows about NEOM's $500 billion budget. What they miss are the peripheral opportunities. NEOM needs:

Workforce housing for 1 million+ workers

Logistics facilities

Service businesses

Supply chain infrastructure

You don't need to build in NEOM. Build around it.

The play: Secure land in NEOM-adjacent areas for workforce housing and logistics. Government-approved investment vehicles now allow foreign capital participation.

5. The Digital-First Development Model

ROSHN's 50% online sales rate isn't an anomaly - it's the future. Saudi buyers, especially under-35s, expect digital-first experiences. Yet most developers still operate like it's 1995.

The play: Build properties designed for digital sales from day one. Virtual tours, AI-powered customisation, blockchain-based transactions. First-movers will capture massive market share.

6. The REIT Revolution

Saudi REITs manage 229 properties worth SAR 30 billion. Derayah REIT alone controls SAR 1.68 billion in assets. Yet most international investors have never heard of them.

Foreign investment is now flowing through REIT structures, offering 6-8% yields in a region with no income tax. After-tax returns crush Western markets.

The play: Accumulate REIT positions before international institutional capital discovers Saudi's yield advantage.

7. The Mega-Project Workforce Housing

Qiddiya spans 334 square kilometres. The Red Sea Project includes 16 resorts. These aren't just construction projects - they're cities being built from scratch.

Each needs housing for tens of thousands of workers. Not temporary camps - proper communities with amenities, as Saudi pushes for higher construction standards.

The play: Master lease entire buildings to construction contractors. 3-5 year contracts, guaranteed occupancy, minimal tenant management.

The Playbook - How to Actually Execute

Opportunities mean nothing without execution. Here's the tactical playbook I've developed for you:

Finding Your Saudi Partner (The Non-Negotiable)

Going solo in Saudi = guaranteed failure. This isn't about legal requirements (though those exist). It's about navigating a relationship-based market where trust trumps everything.

But not all partners are equal. Through painful experience, I've identified three types:

The Connector - Great for introductions, terrible for execution

The Silent Operator - Runs successful businesses, wants passive investment

The Aligned Entrepreneur - Has complementary skills, shared vision

You want number 3. They're harder to find but exponentially more valuable.

The Capital Stack That Works

Forget everything you know about real estate finance. Saudi Arabia operates differently:

Islamic Finance Advantages:

Ijara structures offer better terms than conventional mortgages

Profit-sharing aligns interests

Government subsidies most Western operators miss

The Stake platform proved the model, attracting SAR 135 million from 70+ countries by making Islamic finance accessible to international investors.

Getting Face Time with Decision Makers

Here's what nobody tells you: Saudi's top developers and investors are surprisingly accessible if you know how to approach them. I went from zero connections to meetings with tier-1 players in 90 days.

The secret? No cold emails. Slow, warm LinkedIn relationship:

Reference specific projects they're working on

Offer value, not requests

Be patient - responses take 2-3 weeks

Show your track record (!!)

Paid subscribers get my exact message templates that achieved an 87% response rate (at the bottom).

Timeline Reality Check

Western timelines don't apply in Saudi. Everything takes longer than expected, except when it doesn't. I've seen permits that should take 6 months arrive in 2 weeks, and simple bank accounts take 3 months.

Realistic timeline:

Months 1-6: Relationship building, partner selection

Months 7-12: Legal structure, initial capital

Months 13-18: First project launch

Month 18+: Revenue generation

Anyone promising faster results is lying. Even these timelines are ambitious.

Who's Already Winning (And What They Know)

The smart money isn't waiting. They're building massive positions while Western operators debate market entry.

The Giga-Project Players

ROSHN leads the charge with 400,000 planned units and SAR 19 billion in contracts for their SEDRA development alone. But they're not just building homes - they're building a new development model.

Qiddiya spans an area larger than Las Vegas, with 400+ attractions including Six Flags and the world's largest water park launching in 2025. The spillover opportunities are massive.

The Red Sea Project's 16 resorts opening through 2025 need everything - workforce housing, suppliers, services. First movers are locking in 10-year contracts.

The Smart Money Moves

Watch what they do, not what they say:

Stake's digital fund model proved international appetite exists

Family offices quietly accumulating land ahead of regulatory changes

REITs consolidating fragmented assets before institutional capital arrives

"The opportunity isn't in competing with mega-projects. It's in solving the problems they create - housing, services, infrastructure. The builders need partners, not competitors."

My 2-Year Saudi Real Estate Forecast

Based on 50+ conversations with Saudi family offices and developers this year, here's what's coming:

2025-2026: The Acceleration Phase

3 Months:

White Land Tax forces 15-20% of undeveloped land to market

First wave of distressed sales creates buying opportunities

International operators announce Saudi entries ahead of foreign ownership law

BTR (Build-to-Rent) pilots launch in Riyadh

6 Months:

Corporate housing occupancy hits 95%+ in RHQ zones

REIT consolidation accelerates - expect 3-5 major acquisitions

PropTech investment doubles as digital infrastructure gaps become obvious

First international coliving operator enters Saudi (apart from Flow……)

9 Months:

Foreign ownership law takes effect - expect 30% price surge in designated zones

First international BTR operators launch at scale

Mega-project workforce housing crisis forces creative solutions

Saudi's first PropTech unicorn emerges

2026-2027: The Maturation Phase

Market Predictions:

Residential prices up 25-35% from 2025 levels

BTR becomes 5-8% of rental market (from <1% today)

International capital allocation hits $50B annually

Digital transactions exceed 70% of market

Winners and Losers:

Winners: Digital-first developers, workforce housing specialists, REIT consolidators, BTR operators

Losers: Luxury-only players, traditional brokers, cash-heavy/tech-light operators, asset-heavy models

The Risks Nobody's Discussing

Let's be real about the challenges:

Oil price sensitivity - Less than you think, but non-zero

Execution risk on mega-projects - Delays impact peripheral opportunities

Cultural misalignment penalties - Get it wrong, get shut out

The oversupply myth - Actually undersupply in affordable and workforce segments

Why This Timeline Matters

The window for outsized returns closes in 24 months. After foreign ownership begins and institutional capital floods in, the easy money disappears. This is your iPhone-in-2007 moment.

"By 2028, Saudi real estate will be efficiently priced. The arbitrage opportunities will be gone. The 10x returns will be historical footnotes. Right now, inefficiency equals opportunity."

Your 90-Day Saudi Entry Plan

Theory without action is worthless. Here's your tactical 90-day blueprint:

Days 1-30: Intelligence Gathering

Week 1-2:

Access my GCC Real Estate Investor Database (700+ active investors)

Read these 5 reports: Vision 2030 Housing Program, Knight Frank Saudi Residential Review, GASTAT Real Estate Index, Deloitte KSA Predictions, JLL Living Market Dynamics

Join 3 WhatsApp groups where deals actually happen

Week 3-4:

Identify your niche from the 7 opportunities

Build target list of 20 potential partners

Start soft outreach using my templates (at the bottom)

Days 31-60: Partnership Development

Week 5-6:

First Saudi visit - minimum 10 days

Coffee meetings using my proven framework

Week 7-8:

Legal structure research with vetted firms

Partnership terms negotiation

Background checks (crucial in Saudi)

Days 61-90: Pilot Launch

Week 9-10:

Finalise one strategic partnership

Identify pilot project under $5M

Secure initial capital commitments

Week 11-12:

Legal documentation

Announce market entry

Begin hiring local team

The Reality Check

What $1M gets you in Saudi real estate:

5-10 mid-market residential units

20% equity in a $5M development project

One year of operation costs including local team

You need $5-10M to play seriously. Less than that, focus on partnerships and service businesses.

The Window Is Closing

In September 2019, Saudi real estate was a closed shop accessible only to locals and the deeply connected. Today, it's the world's last great inefficient market - where information asymmetry, regulatory changes, and massive capital deployment create once-in-a-generation opportunities.

By 2030, this window will be shut. The market will be institutionalised, efficiently priced, and dominated by major international players. The arbitrage will be gone.

But right now - in this unique moment - a prepared operator with the right approach can build a $100M portfolio in the same time it takes to develop a single project in London or New York.

The foreign ownership law takes effect in 12 months. The mega-projects are breaking ground now. The digital infrastructure is being built today. This isn't about if you should enter the Saudi market - it's about how fast you can move.

Because while you're reading this, someone else is already booking their flight to Riyadh.

The Bottom Line:

Saudi Arabia's real estate market offers the last great arbitrage opportunity in global property.

With $72 billion racing toward $132 billion by 2033, regulatory walls falling, and digital transformation accelerating, the next 24 months will create more wealth than the past decade.

The question isn't whether to enter - it's whether you'll move fast enough to capture the opportunity before institutional capital makes it efficient. The clock is ticking.

Thanks for reading.

Till next week,

Zakee

Access 700+ Gulf Investors, and my Cold Outreach Template

Get instant access to everything you need to break into Saudi real estate - including the exact outreach sequences that got me from zero connections to meetings with billion-dollar developers in 90 days.